Ever wished you had a mortgage expert available 24/7 to answer your questions? Now you do! We're excited to announce our new AI-powered chat assistant, built with the incredible Assistant UI framework, that helps you understand every detail of your mortgage analysis. 🤖💬

Your Personal Mortgage Guide

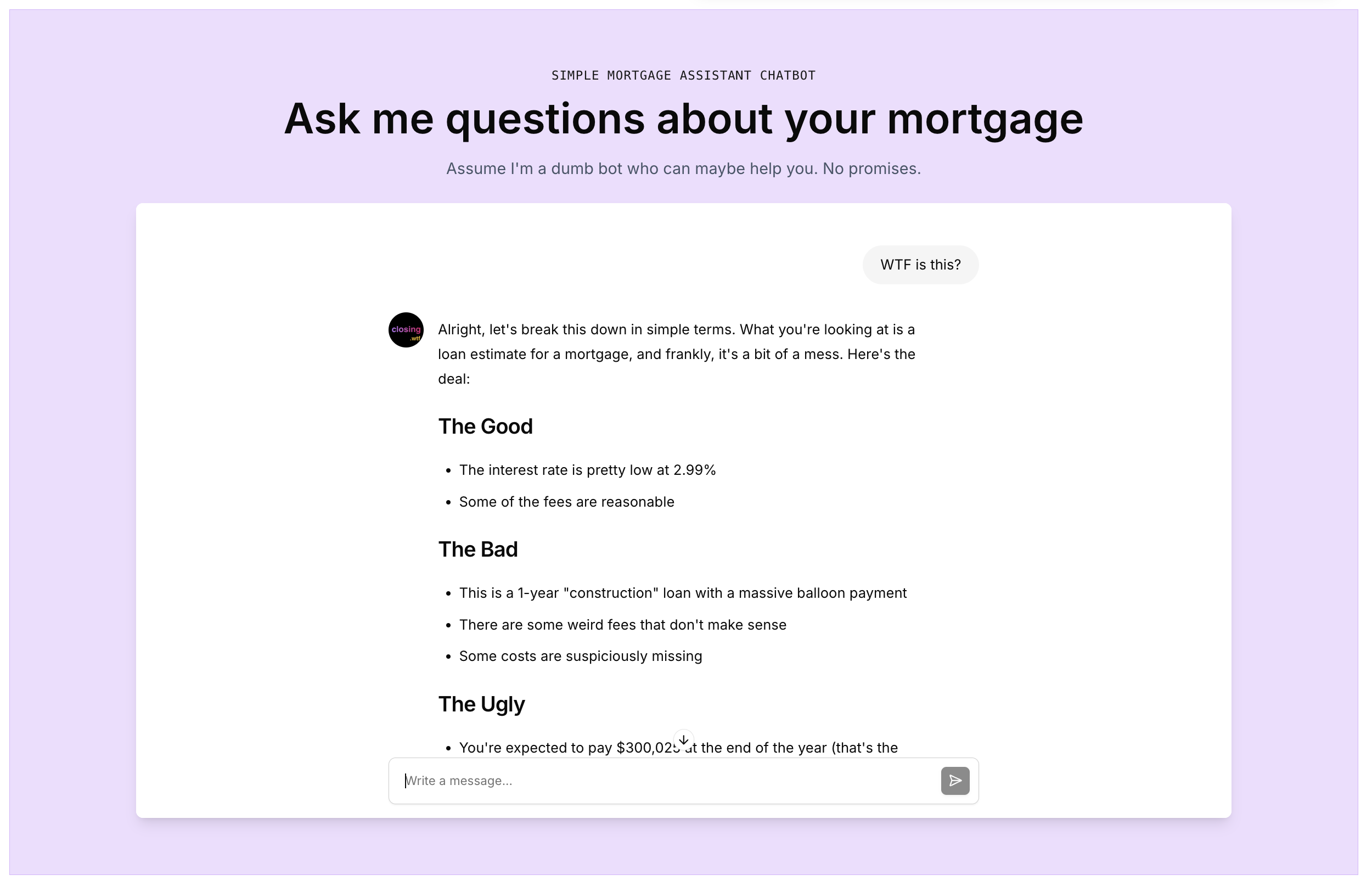

Understanding your mortgage analysis shouldn't require a finance degree. Our chat assistant, built on the powerful and open-source Assistant UI framework, provides:

- Instant answers about your specific mortgage terms

- Clear explanations of complex financial concepts

- Proactive identification of potential issues

- Real-time market rate comparisons

- Smart suggestions for mortgage optimization

Smart, Interactive, and Always Available

Our chat assistant leverages advanced AI technology to provide:

- Contextual Understanding: Analyzes your specific mortgage details

- Natural Conversations: Have real dialogue about your concerns

- Instant Responses: Get immediate answers to your questions

- Data-Backed Insights: Powered by real market data and expert knowledge

How It Works

Using our chat assistant is simple:

- Open your mortgage analysis report

- Click the chat icon

- Ask any question about your mortgage

- Get instant, accurate responses

Beyond Basic Q&A

Our assistant doesn't just answer questions - it helps you:

| Feature | Benefit |

|---|---|

| Rate Analysis | Compare your rate with current market offers |

| Fee Explanation | Understand every charge on your disclosure |

| Term Comparison | See how different options affect your payments |

| Risk Assessment | Identify potential issues before closing |

Your Mortgage Advocate

The assistant acts as your personal mortgage advocate by:

- Flagging Concerns: Automatically identifies potential issues

- Suggesting Alternatives: Provides options for better terms

- Explaining Rights: Helps you understand your borrower rights

- Tracking Changes: Monitors modifications to your terms

Privacy and Security First

We understand the sensitivity of mortgage information. Our assistant:

- Never stores personal financial data

- Operates with strict privacy controls

- Complies with all financial regulations

Start Chatting Today

Don't let mortgage confusion cost you money. Whether you're:

- Reviewing your initial disclosure

- Comparing lender offers

- Preparing for closing

- Understanding final terms

Our AI assistant is here to help you make informed decisions about your mortgage.

Try it now and experience the future of mortgage understanding - where complex financial terms become clear conversations.